When it comes to finances, people are naturally cautious. They want to know that they can trust the institution they are dealing with and that their personal information will be protected.

Phishing scams and malicious websites are on the rise. In 2020, Google registered 2.02 million phishing websites, and the people behind them are targeting anyone who has their guard down.

Financial institutions are the most common target for phishers, accounting for 24.9 percent of all recorded phishing attacks worldwide during the first quarter of 2021.

One reason for these phishing activities towards financial institutions is because they deal with large sums of capital and often the movement of large amounts of capital on a daily basis. As a result, it is essential for financial institutions to establish trust and credibility in their respective websites.

After all, a financial institution’s website serves as a portal for their customers and potential customers. It is the first impression people will have of the business, and they need to make sure it is a good one.

Businesses with a more credible web presence gain a strategic advantage. In 2019, there were roughly 3.8 million Google searches conducted each minute, the majority of which were carried out to search for information on local businesses.

As you can see from this data, it is essential for financial institutions business to have a website that is credible and trustworthy if they want to expand their reach and communicate with customers on a broader scale.

1. Prominently Showcase Trust Seals Verified by Third Parties

Trust seals are accreditations issued by entities such as the Better Business Bureau or McAfee, which indicate that a specific website meets certain criteria.

Third-party verification is an important aspect of trust as it provides an unbiased opinion on the legitimacy of a website. It can help boost trust with customers as it shows that the website has been vetted by an external authority.

Including a trust seal on a website is a great way to show customers that data security is taken seriously and that their personal information will be protected when they do business with them.

There are various different trust seals that cover a wide range of certifications, including having a secure site or adhering to good business practices.

Some seals are so notable that their mere presence may be sufficient to boost conversions, such as those provided by Verisign, Paypal, and Norton. One study found out that there was a 42% increase in sales after securing a Verisign trust seal.

Here are some examples of Trust Seals:

- BBB Accreditation - This is a highly regarded accreditation for businesses located in the USA and Canada.

- Norton Secured - Intended for privacy and online security, it is suitable for enterprise solutions.

- TrustedSite Trustmarks - It actively monitors the website for security issues such as malicious links, malware, and phishing.

While there are various types of Trust Seals, it is important to research and find the one that is most relevant. Once the right one has been found, it needs to be placed in a prominent position on the website where visitors will be able to see it easily

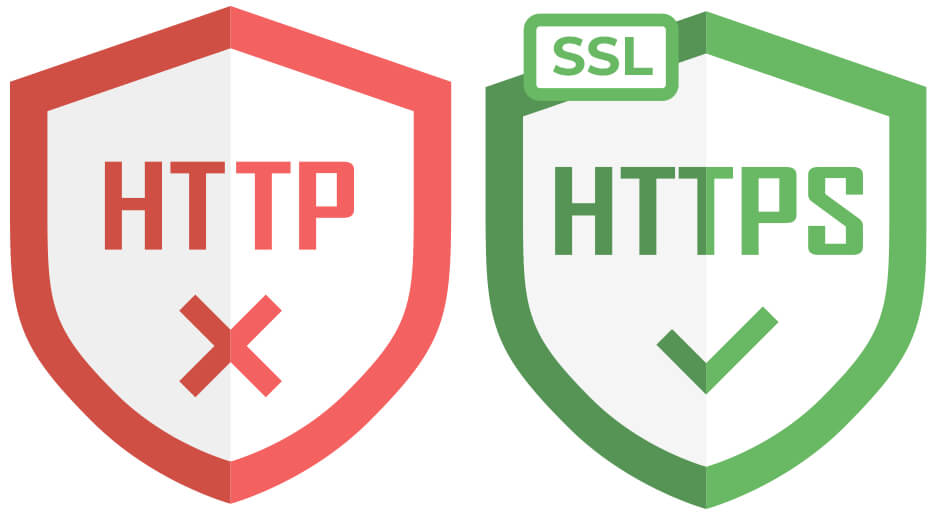

2. Obtain and Install an SSL Certificate

Secure Sockets Layer (SSL) is a protocol that allows a browser and a server to set up an encrypted connection. Before information is sent, it is first encrypted, then decrypted on the receiving end.

This protocol keeps the user's information safe and secure, which is crucial in today's online landscape.

You may be unfamiliar with the term "SSL Certificate," but you have probably encountered several websites that you use on a day-to-day basis that have set up SSL certificates. You will often see an https prefix - instead of http - within the website's URL, and a lock icon in the address field.

The additional "s" indicates that you are accessing that specific website through a secure connection facilitated by the SSL protocol. Clearly, customers feel much more confident knowing that their information is safe and secure, which enables businesses to build trust.

However, the Anti-Phishing Working Group (APWG) revealed that web browser padlocks alone are not that trustworthy.

In fact, some phishing websites are also using free SSL protection to attract victims. They reported that 78% of phishing sites use SSL protection, with 35% of those being SAAS and webmail sites.

With the Premium SSL certificates offered by 101domain, users and website owners are protected against phishing attacks and give safety to website visitors. These premium SSL certificates are 93-97% safer than basic encryption-only DV websites.

3. Display Social Proof (Testimonials, Case Studies, Reviews, & Ratings)

Displaying social proof in a website helps build credibility to financial institutions and helps eliminate visitors' skepticism. It is a form of evidence that demonstrates that other people have had positive experiences with the company or website.

There are many different ways to display social proof on a website, but some of the most common include customer testimonials, case studies, and reviews.

User-generated content such as reviews, ratings, and testimonials can be about financial services or products or a brand as a whole.

Reviews and ratings can fall into two categories: product and brand reviews. Consumers can rate and leave reviews for products or services they have purchased or tried, and they can also rate and review a brand as a whole.

Testimonials are written or video statements from a satisfied customer that praises a financial institution, services, or products.

Case studies are in-depth, written reports that show how the company or product solved a customer's specific problem.

When it comes to displaying social proof, there is no one size fits all solution - research needs to go into finding the type of social proof that will work best for a website and target audience.

However, it is vital to make sure that the social proof content is regularly updated so that it is always current and relevant.

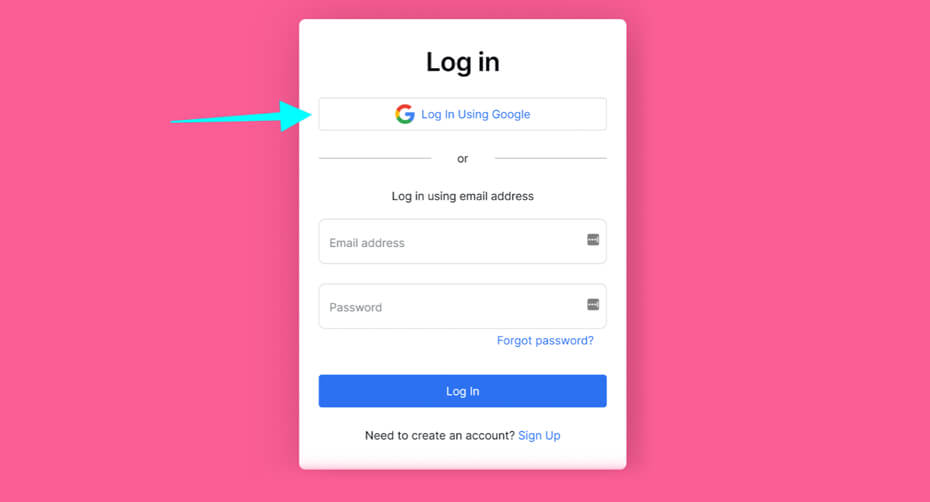

4. Use OAuthFacebook or Google Email Login for Signing In

Including a Facebook or Google email OAuth login on your website is good for users' security and almost makes it seem like there is a partnership between your firm and Facebook or Google.

With Facebook or Google email login credentials, it is easy and convenient to sign in to multiple secure sites.

Further, it helps the user keep their information safe in case of an inevitable data breach. This also helps gather information about the customer, which can be used to improve the user experience on the site.

A survey by Digital Guardian revealed that the average person uses their email address to create about 130 accounts.

However, almost no one creates unique passwords. Instead, more than half of account creators reuse a password for several accounts. This behavior produces serious security risks to the website users.

Offering a Google or Facebook OAuth login on a site means one less password that they need to remember. Including a social login on a website is also a great way to improve the user experience and build trust with the audience.

5. Publish Privacy Policy and Terms of Use

It is important to publish privacy policy and terms of use on a financial institution's website. This helps build trust with the audience by demonstrating that they are transparent about how they collect, use, and protect personal information.

Not only is a privacy policy vital to ensuring that legal requirements have been complied and customer trust is established, but many services and third-party apps require it.

Google is one example. Google requires website owners to have a comprehensive and up-to-date privacy policy in place on the website in order to access specific services and tools (for instance, Google Analytics, AdSense, etc.).

Here's an excerpt from the Google Analytics terms of use:

"You must post a Privacy Policy and that Privacy Policy must provide notice of Your use of cookies that are used to collect traffic data, and You must not circumvent any privacy features (e.g., an opt-out) that are part of the Service."

A website's privacy policy should be easy to find and understand. It should answer questions such as what personal information is collected, how it is used, why it is collected, who it is shared with, and how the user can access and update their information.

The terms of use should outline the rules and regulations that users must agree to in order to use the website or products.

Both the privacy policy and terms of use should be updated regularly to reflect any changes in business practices.

Publishing these important policies on a website (typically linked to from the footer of every page) can help build trust with the audience and improve the user experience.

6. Update Website Content Regularly

It is important to keep a website’s content up-to-date. This helps ensure that the site is always providing accurate and relevant information to the audience.

In addition, regularly updating the website’s content can help improve search engine ranking since updating a website with fresh new content tells the search engines that the site is active and relevant.

Updating content also helps keep the audience engaged. When they see that new and valuable information is consistently being added, they will be more likely to return to the site again and again.

Keep a website’s content updated can be done by:

- Adding new blog posts on a regular basis

- Updating product pages with new information and photos

- Adding new pages or sections to the site

- Regularly updating the FAQ page

- Updating the contact information

- Updating facts or statistics that may be out of date, such as a summary of IRS information or SEC law

This ensures that the audience always has the best possible user-experience when visiting the site.

7. Improve Website's Load Time

A website's load time is the amount of time it takes for the web pages to load when a user visits the site.

A slow-loading website can be frustrating for users and may even cause them to leave the site without taking any action. In fact, based on a NY Times article(paywall), more than half of impatient web users flee slow-loading websites.

Further, a study conducted by Kissmetrics showed that "47% of consumers expect a web page to load in 2 seconds or less and every second you shave off of load time you'll tend to boost customer confidence and trust in your site."

There are many factors that can affect a website's load time, including the size of the images, the length of the videos, the number of plugins installed, and whether or not a content delivery network (CDN) is being used.

101domain’s Secure Web Accelerator Plus is powered by Cloudflare’s global CDN which improves site speed and website performance and decreases server load.

Tools such as Google PageSpeed Insights can be used to test a website's speed and get suggestions on how to improve it.

Improving a website's load time can help keep the audience engaged and improve their trust in your financial institution.

8. Increase Social Media Following

When users see a financial institution has a large and active social media following, they will be more likely to trust the brand.

A strong social media presence can also help build brand awareness and reach new potential customers.

According to Edelman's Trust Barometer Report, around 40% of respondents revealed that they are unlikely to develop an emotional attachment with a brand except if they communicate or interact with them through social media platforms.

The more established a connection with the audience, the higher the credibility.

There are a number of ways to increase social media following, including:

- Regularly sharing engaging and valuable content

- Running social media ads

- Participating in social media chats

- Engaging with the audience

9. Maintain Good Standing with Better Business Bureau

BBB has Business Profiles on more than 5.4 million companies, with a letter grade rating that presents their opinion of the business' responsiveness to customers based on complaints filed.

The BBB Rating System uses points based on marketplace behavior, including how they respond when consumers have had problems. It also takes into account whether there was transparency, truthful advertising, and more.

For several consumers, the Better Business Bureau's letter grades are an important factor in choosing whether to engage in a particular business or look elsewhere.

BBB's rating system is based on how well financial institutions meet their performance standards, which are outlined in the BBB Business Partner Code of Conduct.

The higher the financial institution's rating with BBB, the more credibility and trust from potential customers.

10. Highlight Professional Affiliations and Memberships

If a financial institution is a member of any professional organizations or associations, it is useful to them to have a prominent list on their website.

Some examples of relevant Finance Professional Associations & Organizations are:

- American Association of Bank Directors (AABD)

- American Bankruptcy Institute (ABI)

- American Finance Association (AFA)

- American Society of Pension Professionals & Actuaries (ASPPA)

- Association of Finance Professionals (AFP)

- Association of Fundraising Professionals (AFP)

- Chartered Alternative Investment Analyst (CAIA)

- CMT Association

- Financial Planning Association (FPA)

- Grant Professionals Association (GPA)

- Healthcare Financial Management Association (HFMA)

- Institute of Financial Operations (IFO)

- National Association for Business Economics (NABE)

- National Association of Personal Financial Advisors (NAPFA)

- National Association of Surety Bond Producers (NASBP)

- National Investor Relations Institute (NIRI)

- National Society of Compliance Professionals (NSCP)

- National Venture Capital Association (NVCA)

- Professional Risk Managers' International Association (PRMIA)

- Society of Financial Service Professionals (FSP)

Being a member of these types of organizations shows that a financial institution is committed to upholding the highest standards in the field of finances and is up-to-date with the latest finance industry trends.

11. Maintain Good Standing with Third-Party Review Sites

Listing a business on popular third-party review sites is another great way to build credibility and trust with potential customers.

When users see positive reviews from other independent sources, they will be more likely to trust and do business with the financial institution.

An active, up-to-date page on third-party review sites like Google My Business, Consumer Financial Protection Bureau, and Yelp is essential.

A study conducted by Harvard Business School showed that an increase in rating on Yelp by just one star could also increase business revenue by five to nine percent.

Utilizing third-party review sites can boost online reputation and improve the chances of getting new customers.

12. Use High-Quality Images and Videos

Low-quality images will hurt credibility and conversion rate. People are drawn to visuals, and using high-quality images and videos on a website helps keep their attention.

To build trust, a financial institution site must look like a reputable and professional organization. The landing-page content, as well as main navigation, should be well organized with an appropriate color scheme.

All of the visuals on a website need to be professional and representative of the brand.

Videos can also be especially helpful in showing potential customers what a financial institution is all about.

13. Educate Rather Than Sell

When people are looking for a financial institution, they want to know that they can trust it with their money.

One of the best ways to build this trust is by educating potential customers about personal finance and investment topics.

This will show them that the institution is knowledgeable in the field and capable of providing sound financial advice.

When people feel educated and informed, they are more likely to trust an institution and do business with them.

Additionally, providing helpful content on a website can help it rank higher in search engine results pages.

14. Avoid Colloquialisms and Jargon Within Content

Using complex jargon and colloquialisms in a website’s content will only confuse potential customers and make it difficult for them to understand what the institution is about.

What may be common knowledge to those at your firm or in the industry may be unknown to the typical consumer.

It’s also a best practice to either avoid acronyms or define acronyms.

If jargon, colloquialisms, or acronyms are needed, you can add the familiar "information" icon next to the unknown term or phrase which gives an explanation of it.

Avoiding or defining acronyms and jargon increases transparency, especially in an acronym-heavy industry like finance.

15. Use OnDMARC to Prevent Spoofing

Banks should use OnDMARC to prevent email phishing and spoofing.

Phishing an attack where the attacker attempts to "lure" the recipient into giving them money or information. Spoofing is a kind of attack in which the "From" address is an email that is manipulated to look like or similar to the email coming from a trusted source.

OnDMARC is an email security product that directs businesses to complete DMARC protection for their digital assets quickly and automatically.

Further, DMARC allows for the request of reports from email servers that receive messages from an organization or domain.

These reports contain information to help identify potential authentication issues and other malicious activities for messages sent from a specific domain.

With OnDMARC set up, trust and credibility to a website can be built because people will know that email security is taken seriously.

Google has a great article that provides more details on how organizations can use DMARC to prevent spoofing.

16. Perform a SOC 2 Audit

Information security is a top concern for businesses today. As more and more tasks are outsourced, it is vital that companies take steps to ensure their data remains securely protected at all times.

Vulnerabilities in applications leave organizations vulnerable during attacks like ransomware, data theft, and malware installation.

System and Organization Controls (SOC) 2 Audit ensures that a financial institution provides a safe and secure operating environment where sensitive data is easily managed, and the interests of the organization and clients' privacy are protected.

The audit centers on the internal controls of the financial institutions governing the services of the clients.

Two-factor authentication is one crucial security control that should be included in a SOC 2. This requires users to provide a secondary authentication like a biometric factor or a security token and a password.

This gives an extra layer of security and minimizes the risk of hackers accessing sensitive data. In fact, Microsoft stated that users who enable multi-factor authentication on their cloud accounts block 99.9% of account hacks.

The bottom line is that performing a SOC 2 audit can build trust with their potential customers as it shows that they are taking the necessary steps to protect sensitive information.

Once performed, the completion of this audit can be leveraged for credibility and trust with clients.

17. Provide Details About Customer Service and Support

When customers visit a financial institution’s website, they will want to know how they can contact customer service and support.

Providing clear and concise information about customer support on a website is important. Potential customers will have clarity on whether they will receive the help they need in case they have any questions or problems.

Hours of operation, phone numbers and email addresses should be displayed clearly and prominently so that customers can easily get in touch with them.

18. Provide Links to Financial Resources

Citing the source of financial information, such as tax law from the IRS or compliance information from the SEC is a quick and easy way to add trust, both with customers and search engines.

According to Google's Your Money or Your Life (YMYL) Pages, Finance is one of the categories deemed sensitive by Google.

This was stated clearly on page 10 of the latest Google Search Quality Evaluator Guidelines, wherein Google enumerates the list of pages or websites that are specifically referred to as "types of pages that could potentially impact the future happiness, health, financial stability, or safety of users".

Google is very serious about YMYL pages needing to meet high Page Quality rating standards because it has a great potential to negatively impact a person’s life. Consequently, financial institutions need to be vigilant in their operations and conduct online.

Information on a financial institution’s websites needs to be updated and accurate. Citing the source of sensitive information can help users verify information stated on a financial institution’s website.

19. Make Your Team Members Known

When people visit a website, they want to know who is behind it.

A great tool to use is to have a list of the names of their team members on the website. This will help increase trust with potential customers as they will know that they are a legitimate business and that they have experts working for them.

Listing their roles within the company so that people can get to know them better is helpful. A photo of each team member can be included so that people can put a face to the name.

A brief bio for each team member can also be added. This will help people learn more about them and their qualifications.

20. Increase Transparency on Important Details Such as Fees and Terms

It is essential to be transparent with potential customers about the important details of a business. This includes information like additional costs, contract terms, and data security.

Fee transparency builds knowledge and reduces uncertainty for potential customers. Including all additional costs upfront gives customers a true estimate of what they will be paying, which builds trust.

Contract terms should also be readily available so that customers know what they agree to. This will help them make an informed decision about whether or not to do business with a specific institution.

Data security is another important detail that should be transparent. As mentioned before, there should be a privacy policy in place that is easily accessible on the firm’s website.

This provides website visitors an impression that data security is taken seriously and that the firm is committed to protecting their information.

Trust as the Greatest Asset

Today's digital age can also be a confusing and scary place, especially when it comes to finances. That is why financial institutions need to do everything they can to build trust with potential customers. And one of the greatest ways to do that is through their website.

By implementing the tips provided in this article, financial institutions can create a website that instills trust and credibility in their potential customers. Trust and credibility is an essential determining factor in whether or not a person does business with a financial institution.